The Crucial Role of Cybersecurity in Digital Banking: Essential Strategies to Protect Financial Data

The cybersecurity landscape constantly shifts, with new threats emerging as swiftly as the technologies designed to counter them. This dynamic is even more pronounced in the banking sector due to the critical nature of the assets at..

Exploring Bank-Fintech Collaborations: Innovations Reshaping the Financial Landscape

As we delve deeper into this dynamic interplay between legacy banking institutions and agile fintech entities, we will explore what drives these collaborations, the myriad benefits they bring for all stakeholders, and the complex challenges they must..

The Role of Data Analytics in Personalized Banking

The introduction of big data has completely transformed how banks interact with their customers. Banks can now offer highly personalised services by leveraging the vast amounts of data generated daily. This shift represents a significant departure from traditional banking..

The Impact of 5G on Mobile Banking: A New Era of Speed and Efficiency

Today's consumers demand instant transactions, and 5 G's near real-time processing capabilities meet these expectations head-on. For banks, this increased speed is more than just a better user experience; it's a game-changer for operational efficiency. Faster transactions mean reduced..

The Impact of AI on Employment and Skill Demands in the Banking Sector

Artificial Intelligence (AI) and automation rapidly transform the banking sector, fundamentally reshaping job roles and skill requirements. With over 30 years of experience leading IT innovation and strategic technology leadership..

Sustainable IT Strategies in Banking: Leveraging Technology for Profitability and Sustainability

This article delves into how banks can leverage technology to enhance their bottom line and contribute to global sustainability goals. We will explore green computing practices, energy-efficient data centres, and the role of digital transformation in promoting..

Central Bank Digital Currency (CBDC): A Deep Dive into India's Digital Currency Landscape

Central Bank Digital Currency (CBDC) is a digital form of fiat money issued by a central bank. Unlike traditional digital payments involving private financial institutions, CBDC represents a direct claim on the central bank. This means it is as reliable as holding..

Tech Titans: Advanced Technologies in BFSI GCCs

In the dynamic world of banking and financial services, staying ahead of technological trends is not just an advantage but a necessity. Aparna Kumar has been at the forefront of digital transformation for over thirty years, driving innovation through advanced technologies and cloud..

Fuelling BFSI Innovation: The Role of GCCs

In today's rapidly evolving financial landscape, innovation is no longer a luxury but a necessity. For the Banking, Financial Services, and Insurance (BFSI) sector, staying ahead of technological trends and implementing advanced solutions is critical to maintaining..

Build Better Teams: A Strategic Imperative for the BFSI Sector

In today’s rapidly evolving business landscape, particularly in the Banking, Financial Services, and Insurance (BFSI) sector, an organisation's success is increasingly dependent on the strength and adaptability of its teams. Whether navigating the complexities of digital..

Boards Need a New Approach to Technology: From Defensive Posture to Proactive Strategy

In the era of rapid technological transformation, it’s no longer enough for boards of directors to focus solely on security and IT infrastructure. While these aspects are undeniably critical, overemphasising overemphasis on them can lead to..

AI Fairness: Transforming Ethical Challenges into Competitive Advantages for BFSI Leaders

Artificial Intelligence (AI) is not just a buzzword in the Banking, Financial Services, and Insurance (BFSI) sector. It's a powerful tool that's increasingly shaping our decision-making processes. From credit scoring and loan approvals to fraud detection..

Building a Data-Driven Culture in Financial Institutions: A Blueprint for Success

Data is the cornerstone of decision-making, innovation, and competitive advantage in today's rapidly evolving financial services landscape. As financial institutions grapple with increasing complexities - from regulatory pressures to shifting..

GCCs and Economic Resilience: Reinventing Business Operations in Uncertain Times

Businesses face unprecedented challenges in today's increasingly interconnected and volatile global economy. The confluence of the COVID-19 pandemic, geopolitical conflicts such as the Russia-Ukraine war, surging global inflation, and..

Ensure High-Quality Data Powers Your AI: A Strategic Imperative for the BFSI Sector

In today’s BFSI sector, where digital transformation is the cornerstone of growth, artificial intelligence (AI) has emerged as a powerful tool for driving innovation, enhancing customer experiences, and optimising operations. Yet, despite AI's potential..

How CIOs Can Build IT Teams for the AI Age: A Strategic Guide for BFSI Leaders

Artificial Intelligence (AI) is not just a buzzword but a transformative force reshaping industries globally. In the Banking, Financial Services, and Insurance (BFSI) sector, AI’s impact is profound, offering new ways to enhance decision-making, streamline..

How Companies Can Take a Global Approach to AI Ethics: Navigating Cultural Complexities in BFSI

Artificial Intelligence (AI) is becoming integral to the Banking, Financial Services, and Insurance (BFSI) sector in today's rapidly evolving digital landscape. From predictive analytics to automated customer service, AI is driving innovation and efficiency..

Harnessing Data to Drive DEI Success in BFSI: A Strategic Approach for Modern Leadership

In today’s complex and rapidly evolving business environment, Diversity, Equity, and Inclusion (DEI) have become integral components of organisational strategy, especially within the Banking, Financial Services, and Insurance (BFSI) sector. As..

What High Achievers Need from Their Mentors: Strategic Guidance for Continuous Growth and Success

Whether they are Nobel Prize winners, elite athletes, or top executives, high achievers often seem to have it all figured out. They have achieved remarkable success, possess a wealth of experience, and have a proven track record of accomplishments. Yet..

How Technology Can Help Close the Gender Gap in the BFSI Sector

Like many others, the banking, financial services, and insurance (BFSI) sector Financial Services and Insurance (BFSI) sector wrestles with a significant gender gap, particularly at senior leadership levels. Despite women making up a substantial portion of the workforce..

The Strategic Importance of IT Governance in Ensuring Regulatory Compliance in the BFSI Sector

In an era where financial institutions are under unprecedented scrutiny, the role of IT governance in ensuring regulatory compliance has never been more critical. As a seasoned CIO with over three decades of experience in driving digital transformation across..

Navigating the Common mistakes of Data-Driven Decision-Making in the BFSI Sector: A CIO's Guide to Avoiding Common Mistakes

In the rapidly evolving landscape of the BFSI (Banking, Financial Services, and Insurance) sector, where data is the new currency, organisations increasingly rely on data-driven decision-making to guide their..

Revolutionizing Regulatory Compliance in BFSI: Harnessing Advanced Technology for a Future-Ready Approach

In today's rapidly evolving financial landscape, where digital transformation is the norm rather than the exception, the BFSI (Banking, Financial Services, and Insurance) sector faces unprecedented..

The Art of Data-Driven Decision-Making in BFSI: Striking the Right Balance Between Insight and Information

We are currently in an era of data abundance, which presents unprecedented business opportunities and significant challenges, particularly in the BFSI sector. The stakes are high in this..

The Evolution of Digital Identity in Financial Services: Navigating the Future of Security and Customer Experience

Identity has undergone a profound transformation in a world increasingly shaped by digital interactions. This shift is particularly pronounced in the financial services industry, where digital identity is rapidly becoming..

The Role of Fintech in Shaping the Future of Banking: A Strategic Guide for BFSI Leaders

The banking industry, long known for its conservative approach to innovation, is facing a paradigm shift driven by the rapid advancement of financial technology, or fintech. As digital transformation sweeps across industries, the BFSI (Banking,..

To Improve Data Quality in BFSI, Start at the Source

Data quality directly impacts decision-making processes and overall business success, from customer transactions and risk assessments to regulatory compliance and fraud detection. However, despite the sector's reliance on data, many organisations struggle to ensure its..

Transforming Transformation: Setting Targets That Drive Sustainable Change in the BFSI Sector

Continuous transformation has never been more pressing in today’s fast-paced, data-driven business environment, particularly within the Banking, Financial Services, and Insurance (BFSI) sector. Yet, despite..

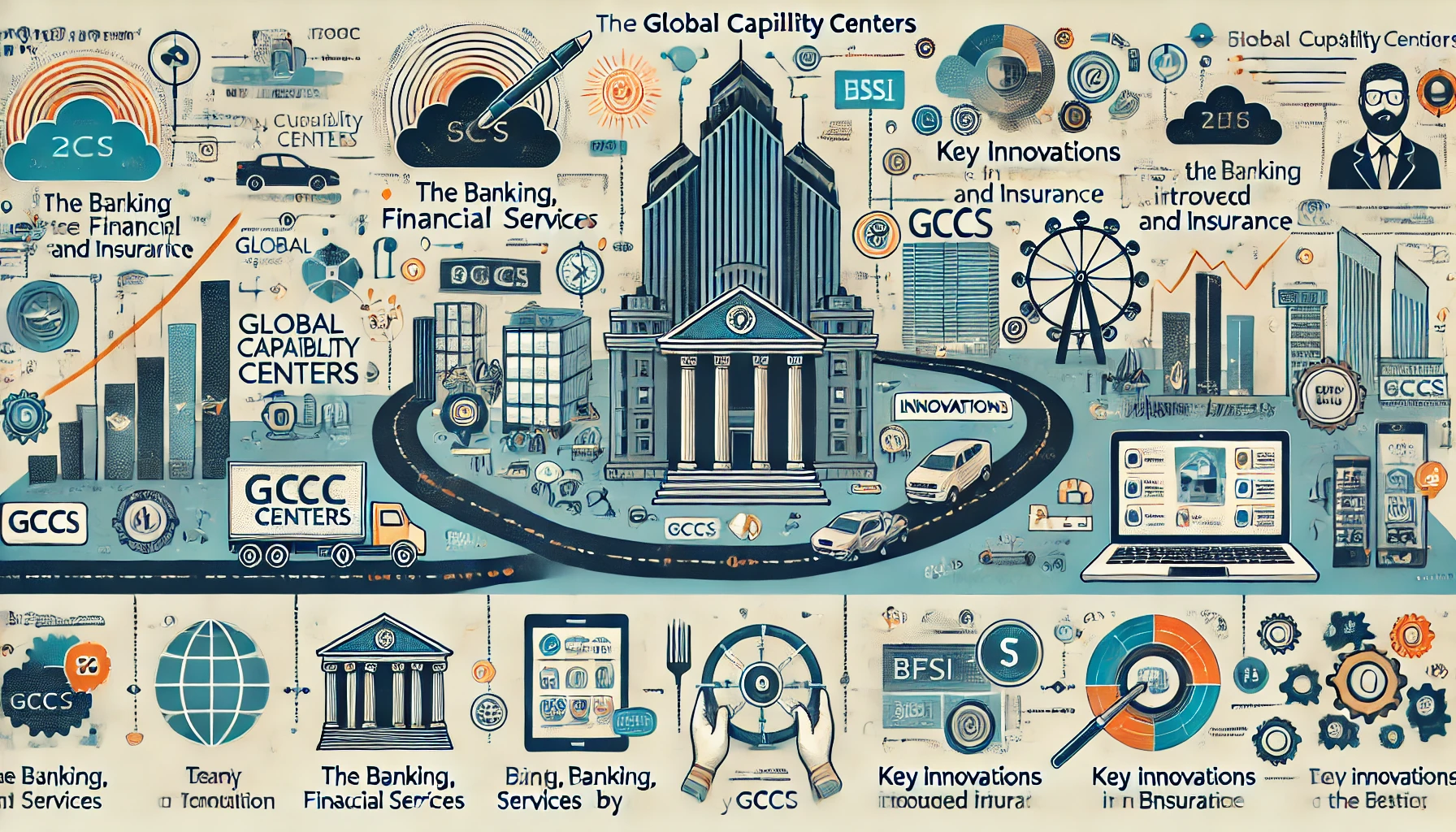

Advanced Analytics and Big Data in Decision-Making: Transforming Banking Strategies

In the dynamic landscape of today's data-driven world, the banking sector stands out for its adept use of advanced analytics and big data in shaping strategic decision-making. As a seasoned CIO and IT Leader with over thirty years of experience,..

AI Revolution vs. Data Protection: Striking the Perfect Balance in BFSI

The transformative power of Artificial Intelligence (AI) offers unprecedented opportunities for growth and efficiency. However, these advancements have significant responsibilities, particularly in safeguarding organisations' vast amounts of sensitive data..

Humanizing AI: The Future of Digital Transformation through Human-AI Fusion in BFSI

The Banking, Financial Services, and Insurance (BFSI) sector is undergoing a profound transformation driven by artificial intelligence (AI). While earlier phases of digital transformation emphasised automation, the new frontier is about leveraging human..

From AI to Cloud: Strengthening Executive Presence in Technology Leadership for the BFSI Sector

The banking and financial services industry (BFSI) is undergoing a seismic shift, driven by the rapid adoption of advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and cloud computing. As a result, the role of technology..

Ethical Risks in Emerging Technologies: How Business Leaders Can Avoid the Pitfalls of AI, Quantum Computing, and Blockchain

Artificial Intelligence is no longer the stuff of science fiction - it has become a cornerstone of modern BFSI operations. From fraud detection to risk modelling, AI has revolutionised how institutions operate. Its ability to..

Unlocking Strategic Brilliance: How Generative AI is Transforming Strategic Planning for CEOs

One of the top bosses of a Gen AI company once declared that we are entering "the greatest golden age of human possibility," and AI will be at the forefront. For CEOs, AI offers the chance to break free from traditional modes of thinking. Instead of..

Unlocking the Future: How Interactive Data is Revolutionizing Legacy Businesses in BFSI

Interactive data, in contrast, offers a game-changing opportunity for BFSI companies. Interruptive data is continuously generated through real-time interactions between customers, digital platforms, and IoT devices, enabling firms to gain immediate..

Is Your Transformation Off Track? How to Spot and Steer Through Critical Turning Points

Turning points are critical junctures in the transformation journey - moments when progress stalls, team morale dips, or external events force a re-evaluation of the transformation strategy. These moments can arise from a variety of factors, both..

Future-Proof Your Sales Team: Overcoming Digital and AI Gaps with Proven Strategies

Digital transformation isn’t just a trend - it’s a foundational shift in how businesses operate. From customer engagement to sales forecasting, digital tools and AI can revolutionise sales processes, making them more efficient, data-driven, and responsive..

Inclusive Leadership in Tech: How Executive Presence and Diversity Drive Innovation and Growth in BFSI and Beyond

In a rapidly evolving business landscape driven by digital transformation, leadership is being redefined to meet the challenges of the modern workplace. Nowhere is this shift more evident than at the..

Redefining Executive Presence in the Digital Era: A Blueprint for Future Leaders in BFSI

The shift to remote and hybrid work has changed how leaders interact with teams, manage performance, and guide organisations. In the BFSI and sectors where digital disruption is constant, leaders must blend their traditional leadership strengths with..

Home About The Author Women In Tech Navigating Future Of Technology Leading IT Innovation Contact

© 2024 Aparna Kumar. All rights reserved.

Disclaimer: The views and opinions expressed in the articles are those of the author and do not necessarily reflect the policy or position or the opinion of the organization that she represents. No content by the author is intended to malign any religion, ethnic group, club, organization, company, individual, or anyone.